Writer’s short message

Hi there, I’m Jimi. I’ve just learnt some thing or two about how we all ended up using Digital Money as our trusted Medium of Exchange, and I’m so delighted to share even further about it with all of you. Here, you will find the complete history of money.

Ahh.. I almost forgot, if you’re interested in website building, script writing, or just want to make friend and have conversation you can email me directly to Jamiejamalullail@outlook.com or just casually send me DM’s to my Instagram account, hence my common username, @khaenyra

Chapter I: Origins of Exchange

What is Money?

Money is a third good that doesn’t spoil and that we all agree has value, thus becoming a unit of exchange; An intermediary good, by which all other goods can be traded indirectly. However, money doesn’t always have value, whether it’s represented by a shell, a metal coin, a piece of paper, or a string of code mined electronically by a computer.

With global wealth estimated to be about $432 trillion at the end of 2023, the value of money depends on the importance that people place on it as a medium of exchange, a unit of measurement, and a storehouse for wealth. But, have we always used money as medium to trade goods and services? well, to answer that we have to talk about the thing that you all might already know. That is Bartering or Trading of Goods.

What is Barter or Trade?

Money has been part of human history for at least the past 5,000 years in some form or another. But before that time, historians generally agree that a system of bartering was likely used. Bartering is a direct trade of goods and services. And as soon as we started to cultivate the earth and form societies, we started to specialize. And that meant that we not only loved to trade, but we also had to.

For example, you might want to trade a stack of meat from a deer you hunted for my barrel of beer I brewed. However, we faced some problems while dealing with local trade. One of them is Coincidence of Wants.

What is Coincidence of Wants?

Coincidence of Wants is the basis on which trade can exist. Let’s say I make shirt, and you grow corns. So, if you want a shirt and I want some corns we can trade, Awesome.

But what if I don’t want your stupid corns and you also don’t want my ugly shirt? Well, that’s became a real problem to society if we can’t trade, even if I still want your food, but you don’t want my shirt, or you probably just don’t like me as a person.

Maybe I can find somebody with some third good that you do want. But that means that a lot of time is consumed by trading. And if I can’t find some other good you want to trade for, well, there’s going to be a trouble. And this problem runs even deeper than we think when you consider the lack of refrigeration and transportation.

Imagine I’m a fisherman and you’re a farmer, and let’s say that we want to trade. Well, there’s this problem; your harvest only comes in once a year. I can’t trade you for a harvest you don’t have yet, and all of those extra fish I caught today are going to be pretty rotten by the time your harvest comes in.

And while this may seem like a very specific example, trade for food was probably the most prevalent trade of the ancient world. So, we need to find a third good that we both want that we can trade for. It would be convenient if we could have this third good which everybody wanted universal. So, we didn’t have to do some long chain of bartering every time we wanted something. Well, this is the part where Money came in.

How did we decide what to use as Money?

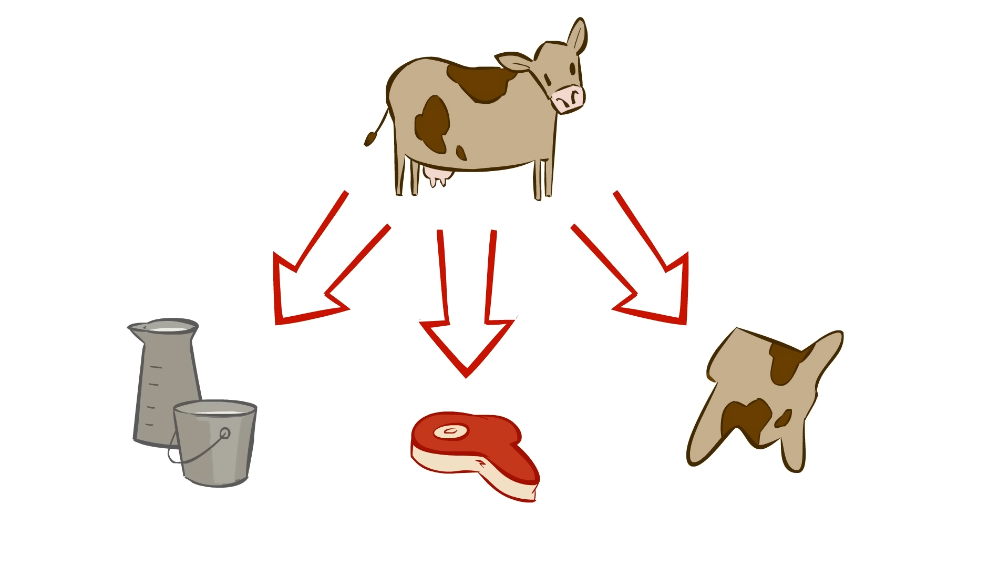

While we often think of coins made of precious metals for this purpose, the truth is, so long as it’s durable enough and hard enough to procure, anything can serve as money. Turns out we have used a lot of weird stuff as money over our history. For example, cattle have often served as money. I mean, they’re fairly durable, they last for years, they’re practical, and they’re reasonably scarce.

When Europeans arrived in the Americas, alcohol often served as currency. Cigarettes have often become money of prisoners. Back in ancient China, money was in the shape of tools like knives, and it became some of the first examples of precious metal money.

And the most unique, on the island of Yap, gigantic limestone donuts serve as money. They are so huge that once they are brought to the island, no one even moves them. They just remember who owns which ones.

“Yeap, that one big circular rock that is bigger than you is your money.” probably that’s what they said after going on an expedition to bring the rock to Yap because all of these stones had to be quarried off-island, since there’s no naturally occurring limestone on Yap.

One day, they went for another expedition, and when they’re coming back, a storm hit and sent their stone to the bottom of the ocean. But the crew survived and told everybody what had happened, and the Islanders decided that “Eh, it still counted.” So, to this day, somebody owns that giant piece of stone money at the bottom of the sea.

And even though it’s not really in use today, for hundreds of years that stone was used to buy and sell things, even though no one had ever seen it, giving Yap, in some ways, one of the most forward-thinking monetary systems before the modern era.

When did Gold Coins come in?

You’re probably asking about it because you think gold coins are the form of money that has been used the longest and over the widest expanse of the globe. Well, to be fair, that’s what I would have guessed too. But nope, not gold. It’s the Cowrie Shell. It’s durable, impossible to counterfeit, and without modern harvesting techniques it’s not so easy to acquire that inflation will run crazy.

Cowrie Shell money is a medium of exchange similar to coin money and other forms of commodity money and was once commonly used in many parts of the world including in China since the 7th century BCE and in India since the 5th century AD. Shell money usually consisted of whole or partial seashells, often worked into beads or otherwise shaped.

We have lots of different possible types of pre-modern money, including the gold and silver coins that we so often think of when we think of money of the past. But all of these different types of money have one thing in common. They are what we call commodity money.

What is Commodity Money?

Commodity money is money whose value comes from a commodity of which it is made or obtained, so the value is in the commodity themselves. We can say that commodity money has its value from its uses, look, and scarcity. Cowries was one because it was seen as rare and beautiful, and can be used for jewelry and the like, and so they were thought of as having intrinsic value. The same way we feel gold has an intrinsic value for its scarcity and its uses.

That makes a lot of sense for a currency. It feels secure and reasonable. You can trust to the worth of that gold coin in your hand. I mean, after all, if you’re used to trading one thing for another, why would you ever trade something valuable like a horse for something worthless like a pile of paper a person claimed as money? But for gold or for cowries, well that’s another story.

But when your economy grows, these types of money start showing some of its limits. For one thing, commodity money is heavy. If you’re doing massive deals, it gets really hard to transport. It’s risky to transport big crates full of gold across lawless lands. Commodity money is also often subject to debasing. Money Debasing is the practice of lowering the intrinsic value of coins where somebody takes a gold coin, melts it down, and reforges it with a bit less gold in it, and passes it off as worth the same amount.

But more than anything, when you get to gigantic economies, the very scarcity that makes commodity money seem to have value becomes your enemy. let’s take gold and silver. What happens when your economy grows to the point where you just can’t get enough of it? This really comes into effect when we get to more modern government finance, and the financing of war. What happens to a nation when it has to make a sudden drastic uptick in its spending, but can’t get enough gold to cover its cost?

And the reverse of this is true as well. Currencies based on scarcity are often subject to changes in the scarcity of the commodity on which they’re based, which can be trouble when somebody finds a lot more of your currency commodity. For example, When Christopher Columbus brought back to Spain a massive amount of silver and gold from the Americas, all the precious metal-based currency in Europe started to suffer from inflation. After all, all those gold coins weren’t worth nearly as much since somebody had just dumped a huge new pile of gold on European shores.

And as a government, or even a financial sector, when someone digging up a new pile of minerals means that you can’t control your own fiscal policy, then that’s bad news. That could be the death of economy. And Yeap, a famous Spanish sailor almost made it happened to the European economy because he had too much gold. Oh, I’ve just thought of an idea, why don’t we talk about gold now?

Chapter II: Origins of Currency

When did Gold Coins come in?

In 600 BCE, metal coinage was invented when Lydia’s King Alyattes minted what is believed to be the first official currency, the Lydian stater. The coins were made from Electrum, a mixture of silver and gold that occurs naturally, and the coins were stamped with images that acted as denominations.

The Lydian stater had many importance as the World’s First Coin. Lydia’s currency helped the country increase both its internal and external trading systems, making it one of the richest empires in Asia Minor. Today, when someone says, “as rich as Croesus,” they are referring to the last Lydian king who minted the first gold coin.

In ancient China they invented a coinage system where the coins had holes punched in them. So, if you needed to measure out large denominations you could just run a string through the center of the coins and a particular length of string would hold a hundred or a thousand at once.

Gold coins is so popular. Even over the last 2.600 years, gold coins have been and are still used as medium to trade goods and services to this day. The United States, Canada, China and South Africa are just a few examples of nations that still produce gold coins in large quantities for the precious metal trade.

It’s almost the best. Well, it is not the best because the use of gold coins started to face its problem when you have bigger size and complexity of transactions. When transactions got bigger, and merchants found themselves needing tens or hundreds of thousands of coins to complete transactions how are they going to move all that money? A strand of a thousand of coins weight about 10 pounds already. So, it became a real pain in the neck to transport them.

But, as human, we always found a way out of our problem. Just like this one right here. “Oh, we can’t travel these carts of gold to another city? How about we use pieces of paper that have the amount of coins we owe the holder written on them and they can come pick up their coins at the Capital whenever they want their money?”. Wait, is that…

How we transitioned to using Paper Money?

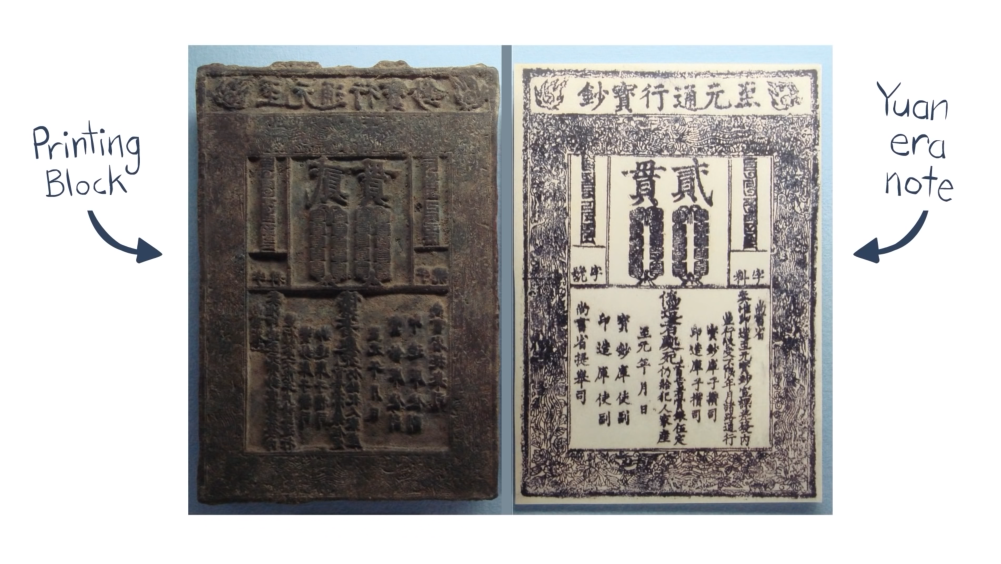

During 1260 CE, the Yuan dynasty of China moved from coins to paper money. By the time Marco Polo, a Venetian merchant, explorer, and writer who traveled through Asia along the Silk Road, visited China in approximately 1271 CE, the emperor of China had a good handle on both the money supply and its various denominations. This event also documented in the book of the marvels of the world or as we know it “The travels of Marco Polo”, there’s a chapter titled “How the Great Khan Caused the Bark of Trees, Made into Something Like Paper, to Pass for Money Throughout his Realm”.

This pieces of paper had the amount of coins written on them to mark its value or denominations to temporarily trade goods. And after a while, these paper slips started being circulated everywhere, and soon, merchants realized that these slips of paper were always good. That they could be turned in at the Capital for however much was written on them whenever they wanted. So, why even goes to turning them in? Why not just trade the slips of paper to other merchants for their goods?

Thus, the merchants began using these promissory notes or essentially Government IOU as money and then the government caught on and simply started printing up money. So, by the time we got to the travels of Marco Polo, paper money was widespread, and this idea started to catch on even outside of China.

However, parts of Europe still used metal coins as their sole form of currency for quite longer period. Colonial acquisitions of new territories via European conquest provided new sources of precious metals and enabled European nations to keep minting a greater quantity of coins. But always being at war made carrying around great piles of coins a bit of a danger. So, in the 16th century after influenced by the tales from China, European merchants, especially in Italy, started to take stronger hold of the idea of using the paper money.

The Italian city-states, like Milan, Venice, and Florence were the economic dynamos of Europe and the first truly great trading cities on the continent since the ancient world. At first, they began simply issuing promissory notes, basically IOU’s.

Merchants would get to a new town and stock up on supplies and trade goods but rather than carrying all the coins to pay for them across dangerous country, they just give the seller an IOU, often backed by a very famous or wealthy merchant, promising to pay for the goods at a later date. But here’s the trick. To keep anybody from having to haul all that coins around, the merchants wouldn’t ever actually end up paying the seller directly. Instead, a merchant would just pay a bank in his hometown.

Here’s how it would work. The merchant selling the goods would take the promissory note he got to his local bank and cash it in for slightly less than its face value. Basically, the bank was buying the note from him for some amount less than it was worth. Then the bank which would have branches in other cities would send a rider with a stack of these notes out to whatever specific city those notes had originally come from.

But what if the bank didn’t have a branch in the merchants hometown? Well then, the bank would just sell the promissory note to another bank that did have one there.

When the rider got to the city, he would hand them to the local branch of the bank and then the local branch would go collect from the merchant who had bought the goods. So, the merchant could pay for goods in a far-off location by paying his local bank after.

It’s pretty huge step forward for commerce. So, these promissory notes sort of started to take on a value of their own. People started trading these notes, and soon the bank’s got in on the action by started using paper notes for depositors and borrowers to carry around in place of metal coins. These notes could be taken to the bank at any time in exchange for their metal coins, usually silver or gold coins.

This pieces of paper could be used to buy goods and services. In this way, it operated much like currency does today in the modern world. However, it didn’t reach the full form of paper money we know today for quite some time because it was issued by banks and private institutions rather than the government, which is now responsible for issuing currency in most countries.

How did Banknotes become our currency?

Tuesday, 30 January 1649 outside the Banqueting House on Whitehall, London. Charles I, the king of England, Scotland, and Ireland, was executed. He was known for many things including seizing all the coins in the mint and declared it to be another one of his ever-popular forced loans.

In the aftermath of Charles I’s Monarchy, a bunch of merchants and goldsmiths got together and the goldsmiths started renting out a corner of their giant vault and offered safe custody of customers’ valuables including golds. And thus we had the first idea of safe deposit box that is still implemented in modern banking nowadays.

Another breed of blacksmiths started paying people small amount of interest to leave their money with them, in exchange for the right to lend it out. This basically made them into banks. And in their capacity as banks when people would deposit their money, the goldsmith’s would basically give the depositor receipt which they could turn back into claim their money. But soon these goldsmiths made a pivotal switch. They changed from making out receipts, which could only be redeemed by the person who originally made the deposit, to also offering receipts that could be redeemed by whomever held them. This allowed people to start using their receipts as currency. Rather than pay for something with a pile of coins, why not just put that pile of coins in the bank and pay for stuff with these far more convenient receipts?

When they started doing this people began to ask for multiple receipts in small regular denominations. So you go to the bank, you drop off 20 quid and ask for 20 receipts of one pound a piece so that you could go out and buy some vegetables or something with them. These receipts eventually evolved towards what we know today as Banknotes. The fundamental form of paper money.

The goldsmiths were clever folk. They started to notice the funny thing about banknotes. These banknotes were starting to get passed around from hand to hand without often getting handed back in at the bank, which meant that the bankers could keep playing around with the money those notes were supposed to represent even as they circulated through the markets. After all so long as everybody doesn’t try to turn in their bank notes at once, the bank can lend more money than it actually has its vaults.

While one bank note is circulating its way from hand to hand, the bank can use the coins that note represents to cover somebody else turning their bank note in. And thus Fractional Reserve Banking was born, instantly expanding the money supply of England. But not without introducing some dangers.

What Is Fractional Reserve Banking ?

When you create an account at a bank, in the contract, you agree to allow that bank to use a percentage of your deposits as loans to other bank customers. This doesn’t mean you don’t have access to the money you deposited; it only means that if you want to remove more than the percentage a bank keeps on hand, such as the entire balance, from the account, the bank will need to access funds from somewhere else to give you your balance. This is exactly what Fractional Reserve Banking is.

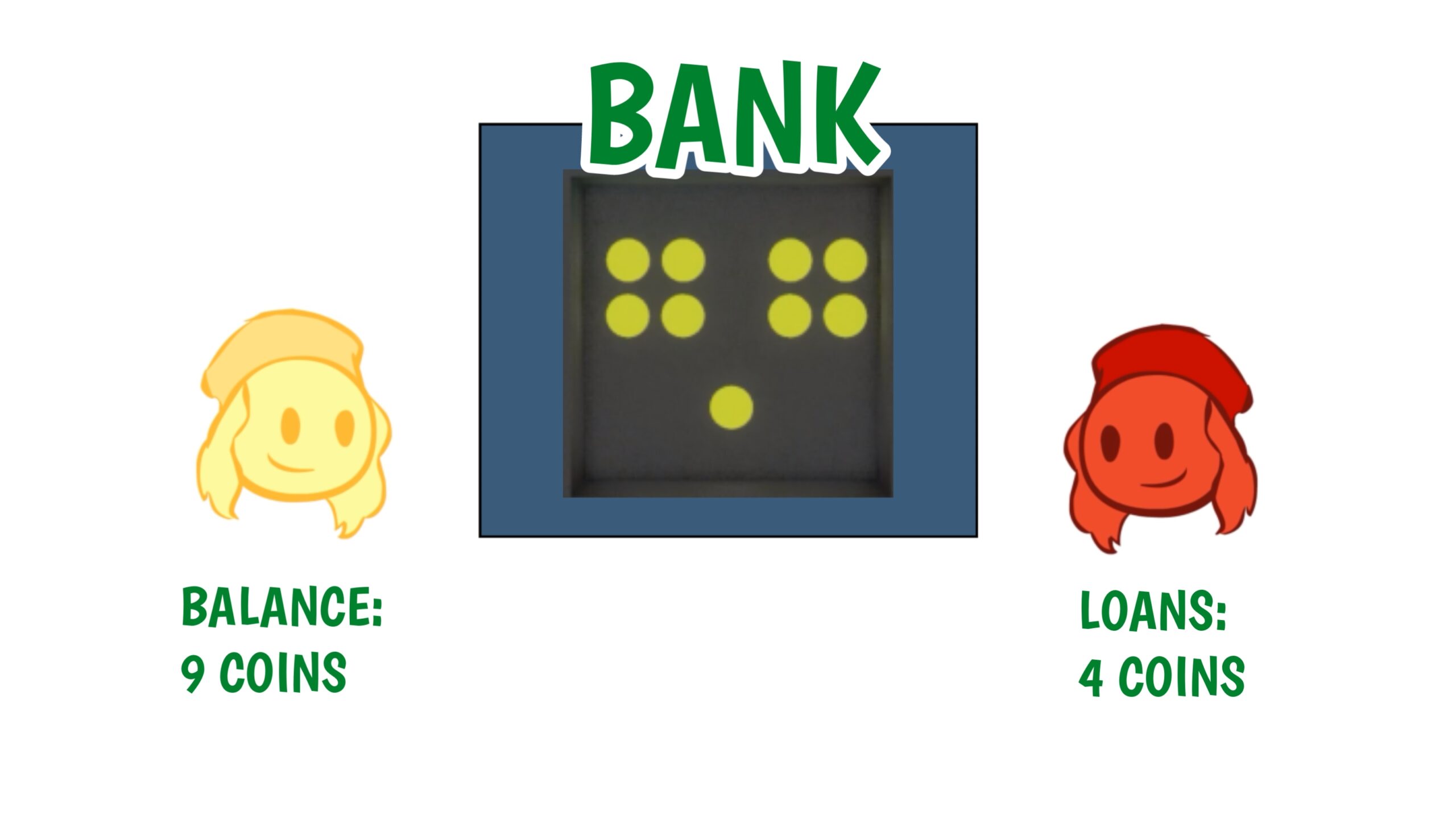

Fractional reserve banking is a system in which only a fraction of bank deposits are required to be available for withdrawal. Banks only need to keep a specific amount of your cash on hand, usually about 6,5% – 8%, depending on economic conditions. And the banks can use the rest of your money to create loans, in exchange you will get interest. This fractional reserve banking process creates money that is inserted into the economy. Let me give you an example to help you understand.

When you deposited 9 coins to a bank, your bank might lend 90% of it to other customers. And when there’s another person in need coming to the bank to take out a loan, let’s say that guy asking for 4 coins loan, your bank can give that person his loan out of your 9 coins, while still keeping your balance reflects as 9 coins. And if we count all the money, the number of coins increased from just 9 coins to 13 coins. This is how Fractional Reserve Banking creates money. But this practice also introduce to some dangers if regulated incorrectly.

Remember when the Goldsmiths of London realized that using banknotes, they could actually lend out more money than they had gold or silver to cover. Well, in early 1660s, in Stockholm, they really went to town. Soon, there were so many banknotes out there, that people couldn’t help but notice, And as soon as people noticed, everybody rushed to the bank to get their banknotes turned back into coins. Which of course they couldn’t do. And there goes the Swedish economy.

After all, if your entire economy is based on gold and silver, then your economy could literally only be as big as the amount of gold and silver you have no matter how advanced your banking systems are. Which is why a radical economist like Nicholas Barebone of England speculated that even gold and silver don’t have a innate value. They are just worth whatever the market values them at. So instead of stockpiling more gold and silver to grow your economy why don’t you just get rid of gold and silver entirely and move to paper money?

Chapter III: Official Money

Who’s going to issue the money?

We’re all now used to there being some central authority in each country or currency block issuing one currency that everyone accepts at face value. But you have to remember that paper money didn’t enter the world as part of some top-down system. Instead, it basically started with a bunch of bankers realizing that they could give people receipts for gold and silver, instead of actually giving customers their gold and silver back. Which means that, one by one, every bank basically started printing their own banknotes. And that is a mess to deal with.

Now, imagine you deposit $10 worth of gold in your local village bank, then they hand you back $10 worth of their shiny, bank-specific banknotes. Now, you go off to the big city to spend your money. But, when you bring out your money to spend it on something there, the big-city merchant might simply not take it.

And if you managed to found a merchant willing to take your notes, they’re more likely to pull out some big chart and say to you: “Well, let’s see… Your bank is pretty far away, so if we (or our bank) ever wanted to redeem these banknotes of yours, we’d have to travel all the way to your village. So, since that’s going to be such an expensive hassle for us to do, we are only going to take your banknotes at 50% value.”

And so, your $10 that you deposited in your local bank would only have $5 of purchasing power in a neighboring city. So clearly every country needed a unified currency that everyone could believe in. And almost all of the problems we’re going to see with the move to paper money are solved in nearly every country with one great innovation. Introducing, The Central Bank.

What Is a Central Bank?

Nowadays we know that a central bank is an institution that manages the currency and monetary policy and regulation of a country and member banks. In contrast to a commercial bank, a central bank possesses a monopoly on increasing the monetary base.

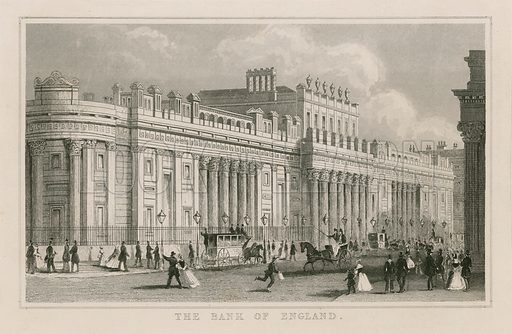

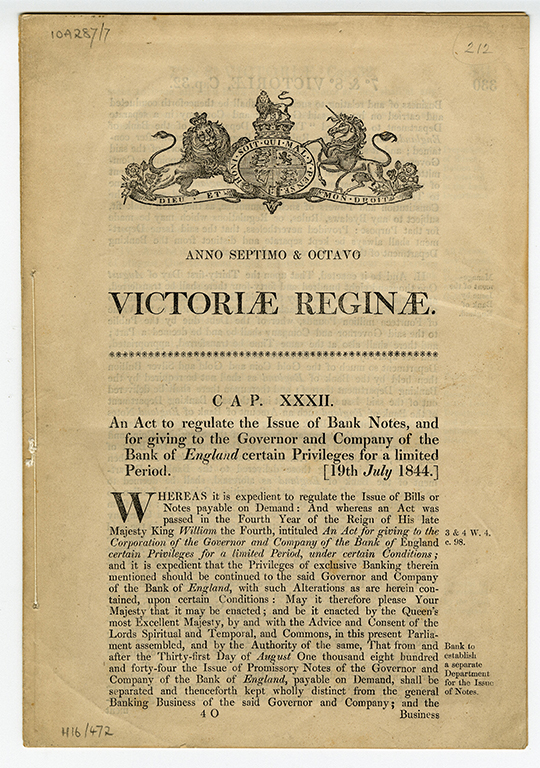

While many early central banks share a similar tale, if we’re going to talk about the first institution that we would call a ‘central bank’, we have to talk about the story of the Bank of England. Established in 1694, The Bank of England is the central bank of the United Kingdom and the model on which most modern central banks have been based.

The Bank of England invention was a powerful thing, because having the government do all of its banking with your bank makes your bank pretty secure. and means that the bank is going to need to have branches or, at least, banks that they work closely with, all over the place. And because of this security, people started to value Bank of England banknotes over most of the other ones out there. At times, people would even pay a premium for them offering £1.1 or £1.2 per £1 note simply because they were reliable and universally accepted.

But, the Bank of England note really wouldn’t become the official banknote of the country until 1844; the middle of the 19th century. With the Bank Charter Act of 1844, no new bank would be granted the right to print banknotes, and it would have to remove its notes from circulation, meaning that, eventually, the Bank of England banknote would be the only paper money in the land. But even with this system, it wasn’t until 1921, that the last non-Bank of England bank in the country stopped printing their own banknotes.

And in Scotland, and Ireland, there are still – to this day – a few banks that retain their ancient right to print pound sterling notes. So, this system of having one unified currency that we think of as a money isn’t really that old. In fact, in the United States, less than 100 years ago, non-Federal Reserve banknotes were still being issued until as late as 1935.

However, even after central banks basically solved the problem of the lack of a centralized currency, there are still problems to face, which one is Fractional Reserve Banking. Because until the point of The Bank of England establishment, any banknotes issued still had to enable people to exchange their banknotes for the equivalent value of gold. This is more or less what is known as the gold standard.

What Is The Gold Standard?

Despite banknotes had already widely spread and more commonly used, many people still require one more step to really gain confidence in the idea of taking milled tree bark in return for their labor, and that would be the Gold Standard.

The Gold Standard is basically the idea that your paper money is backed in gold, that at any time you could take your paper bill and redeem them for a specified amount of gold.

The Gold Standard solves two major problems. The first is inflation. As you can probably guess, it wasn’t long after people started printing paper money when they figured that they could just print a lot of paper money. Way more paper money than they could ever redeem. Way more than even our fractional reserve banking system thinks is sane. As soon as people did that you started to get inflation, and it could still happen even with the central currency controlled by the government.

When countries needed to, let’s say, pay for an army, they would sometimes just print more bills to do it. More bills means that each bill is worth less. Which is exactly what an inflation is. This had became a problem not only for the citizens who’s depended in those paper bills, but also for other countries who’d been accepting those paper bills in exchange for their goods. Which brings us to the second major issue that the Gold Standard addresses, which is Exchange Rates.

Right as paper money was becoming the standard in Europe, international trade was really starting to pick up. Merchants from Europe might go over the continent to trade goods. But what happens when your ship docks in some foreign port, and you try to hand the local merchant your funny green paper money to buy their goods, while they try to hand you their funny pink paper money to buy what you’ve got on your ship? Well you both just sit there scratching your heads for a while.

Back in the day, you would have just weighed whatever coins they were trying to give you, and accept them for their weight in gold. But now they’re handing you this piece of paper that you don’t recognize and you have no idea how to value. But if both currencies are on the Gold Standard, problem solved.

Just as an example, let’s say that at any time you could turn in 20 US dollars to get one ounce of gold. Now let’s say you sail to England and the UK has set their gold standard so that an ounce of gold is worth two British pounds. This makes it nice and simple. Since you’re both operating on the Gold Standard, that means 1 British pound is the equivalent in value to 10 US dollars. Simple. And overall, the use of the Gold Standard held up pretty well throughout the 19th century. So, why aren’t we still using the gold standard these days?

Why aren’t we still using the Gold Standard today?

The year was 1914, World War One clashed. The Seminal Catastrophe. And like so many other things the Gold Standard crumpled under the impossible needs of the War. Nation after nation abandoned gold and went to print more money. And as more and more money was printed and spent to feed the insatiable hunger of this war, trade became erratic.

Trade from the United States grew far beyond what the gold reserves of Europe could bear. Inflation ran rampant. And after the war, many countries couldn’t drag themselves back to the Gold Standard. Some nations like Germany, who are spiraling into hyperinflation under the crushing debt of war reparations, tried to stabilize their currency by backing it in land rather than gold. Others like England appealed to people’s patriotism and imposed themselves back onto the Gold Standard by asking people not to redeem their money for gold, just out of love of country.

Every country suffering from inflation after war were just trying their best to come back to the Gold Standard. Because without the Gold Standard, how is money worth anything? But those good times didn’t have a chance to come back because then came the big one. The World War Two.

World War Two lasted 6 years and it was the most expensive war in the history. Adjusted for inflation to today’s dollars, the war cost over $4 trillion. Economically, it was totally unsustainable, many country involved sinking into massive debt. But the world had learned from World War One. And as World War Two round down, many of the major powers met to work out the first real international monetary agreement. The Bretton Woods agreement.

What Is The Bretton Woods Agreement?

At the verge of the end to the World War Two, the US basically had everybody’s gold, because everybody had bought a ton of stuff from the US for the two biggest wars in history. So the US actually WAS still on the Gold Standard. And how all the other countries could re-stabilize their economies without being able to go back to the gold standard? Well, The Bretton Woods Agreement.

The Bretton Woods Agreement is basically an agreement under which gold was the basis for the US dollar, and other currencies were pegged to the US dollar’s value. So every country had to keep some Dollars on hand to redeem their currency, which is how the US dollar became the reserve currency for basically the entire world.

Approximately 730 delegates representing 44 countries met in Bretton Woods, New Hampshire, in July 1944 with the principal goals of creating an efficient foreign exchange system. The agreement also created two important organizations, which are the International Monetary Fund (IMF) and the World Bank that remained strong pillars for the exchange of international currencies.

How did the Modern Paper Money became Official?

After the gold-backed US dollar basically became the world currency, it also become overvalued all over the globe. But ironically, US involvement in the Cold War and other wars like Korea and Vietnam ended up draining US resources and sending US gold overseas.

So, on 15th August 1971, Richard Nixon, the 37th president of the United States, took the US dollar off the Gold Standard. Let’s take that in for a moment, 1971 isn’t even 100 years ago, even my grandmother was born before that.

And here’s where it gets good. When Nixon pulled the US off the Gold Standard, the shock was felt around the world. Although Nixon’s actions did not formally dissolved the existing Bretton Woods system, the suspension of one of its key components ended its effectiveness because you would no longer exchange gold for US Dollar. This event is remembered as the Nixon shock.

But it didn’t stop many countries from still pegging their currency to the US dollar. So now you had currencies around the world redeemable for US dollars and the US dollar pegged to nothing. And soon many other countries decided just to let their currencies float, to let them be valued at what the market would bear.

And so, just like that, almost by accident, after 6,000 years, we finally accepted money as an idea rather than a thing. Or as John Law would say: “we accepted money as the medium by which things are exchanged, not the value for which they are.” and this idea started to become even wilder when the digital world hits our economy.

Chapter IV: The Digital World

How were The Modern Payment Methods born?

The Paper Banknote was one of the greatest thing that had graced our economy. It ease the way people proceed their transaction in even bigger scale. Beside the many problems it came with, its convenience helps to grow the economic activities and the security also helps to grow trust among buyers and merchants. Also at this point in history we have already seen money as an idea, so actually this paper money is just here waiting to be replaced by another medium.

Nowadays, we’re slowly leaving the paper money as we’ve invented other forms of money to process our transaction. In the late 20th century, payment cards such as credit cards and debit cards became the dominant mode of consumer payment. As for me, I pay for everything with cards, nothing in cash. I mean, why walk around with cash that can be lost or stolen when I can just slip a card under my phone case that basically pays for everything? Well, while all the convenience of payment cards sounds very “nowadays”, it’s actually started quite a long time ago.

The early predecessor of payment cards dates back to the 18th century when merchants—mostly taxi companies and department stores—began to give their beloved customers copper tokens known as Charge (or credit) coins. These coins allowed customers to pay at the time of the purchase without cash. And of course people loved about how this idea worked, especially the farmers as they could wait until after their harvest to pay their bills.

However, copper coins was a little inconvenient even just as tokens. So, In the late 19th century, other breed of merchants began issuing paper loyalty cards, allowing customers to run up a monthly balance of debt, that was in turn collected by the store’s representative at the end of the month. Making in even easier for you to go to your local store to buy vegetables or something by just showing your card and pay for them later. Soon, this piece of loyalty cards evolved towards what we know now as a credit card.

When did Credit Cards come in?

This store loyalty card had started to become really popular in the late 19th century. However it was much more about securing customer loyalty than offering purchasing convenience. These cards required a long and tedious manual credit card transaction. The sales clerk would take the customer’s card and manually copy down all the information. The customer then signed to form which the sales clerk would manually mail to the bank to get their payment settled or just ask for the customer to come to the store with stacks of cash to pay their monthly debt. So, it’s still a bit of a trouble.

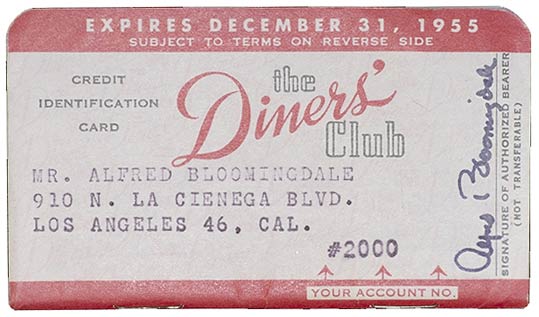

In 1946, John Biggins, a banker from Brooklyn, introduced the Charg-It card. The card worked on a local, closed-loop system, with all of the purchases being routed through Biggins’ bank. The bank paid for the purchase and the customer paid for it through their account at Biggins’ bank at a later time. Charg-It is now known as one of the predecessors to modern credit card. But, if we want to talk about the real first major credit card, we have to talk about the Diners Club Card.

What is Diners Club Card?

The year was 1949, a businessman named Frank McNamara was dining at a fancy New York City restaurant, Major’s Cabin Grill, when he realized that he forgot his wallet at home. Luckily, his wife was able to come to his rescue and stop by to pay the tab. Frank was so embarrassed about this whole situation that he resolved to never face something like that again.

Together with his business partner, Ralph Schneider, Frank started working on something called the Diner’s Club card, which was a cardboard credit card that could be used to pay at a bunch of different restaurants across New York City. By February of 1950, Frank returned back to that New York City restaurant that left him so embarrassed and used his newly invented Diner’s Club card to make the first ever credit card payment. According to the Diner’s Club website, this event was hailed as the “First Supper”. which paved the way for credit cards for decades to come, and many consider this to be the first ever general purpose credit card. Such an interesting story, right? Well, I’m sorry to tell you that the story is made up.

People like a good story a lot more than hearing about the boring details behind what goes into creating a credit card and the financial system behind it. Frank’s restaurant story was invented and glamorized by Maddie Simmons, Executive Vice President in at Diner’s Club as part of brand marketing, to publicize and increase the adoption of their credit card.

The more accurate story is that Frank was a regular at this particular restaurant. I’m talking eat lunch there every day. And as a regular, he was already able to set up a tab and pay his bill on a monthly basis, similar to how a credit card works. In fact, restaurants and stores had already had cards for many years at this point that allowed customers to pay their bills at the end of the month. However, this was accomplished by each business issuing their own cards to their customers, so people would need to carry many different cards around for all the places at which they wanted to pay with credit.

It’s easy to argue that this concept is what eventually became the Diner’s Club card, which was just a single card that could be used at many different restaurants and shops around the city. Frank basically went around the town offering to businesses his Diner Club’s service to pay for customer credit in return that they accept his card as a method of payment. Eventually, Frank’s favorite restaurant became the first place to accept this credit card.

The Diner’s Club card would continue to gain popularity over the years, as more and more businesses began to accept the payment method. Businesses in the United Kingdom, Canada, Cuba and Mexico also begin honoring Diners Club, making it the first internationally accepted charge card. After all, who doesn’t appreciate the convenience of carrying a single card around instead of a bunch of cash? But, keeping your credit balance in a piece of cardboard sounds kinda risky isn’t it? Cardboard isn’t very durable and won’t last long in your wallet.

How had Payment Card evolved?

The 1960s came the shift to more long-lasting payment cards, with banks issuing plastic cards to their customers after American Express started the trend in 1959, hotly followed by the Bank of America and Diners Club 1961. It’s also during this era that credit card sizes were standardized – with the generic size of a credit card based on the size of the first credit card issued by Bank of America.

Soon, many innovations were made. One of the major invention is the magnetic stripe (magstrip) developed by an IBM engineer, with the story going that he wanted to combine a strip of magnetized tape with a plastic identity card, for CIA officials. He couldn’t figure out how to get the two items together, until his wife suggested he use her iron to essentially melt the strip on. This stripe made transaction easier since it can read and record account data, and a signature for purposes of identity verification. So, No need to go through boring manual process of collecting customer data. And In the former case, for every transaction customer will receive a slip to sign then the cashier must verify that the customer’s signature matches that on the back of the card to authenticate the transaction. Pretty secure right?

Well, Using the signature on the card as a verification method still has a number of security flaws. If you lost your card, somebody who’d found it might have relative ease to misuse it, because your signature is literally there on the back of the card. It’s not very hard to fake a signature after all. So, it’s obvious that a better security system was needed.

Chip and PIN (personal identification number) cards came to save the day in the late 1970s, after two German engineers, Helmut Gröttrup and Jürgen Dethloff, first incorporated a silicon integrated circuit chip into a plastic smart card. It took a while for the chips to make it into payment cards, with the first smart, or chip and PIN, cards being issued by France’s Carte Bancaire in 1986. Germany followed shortly afterwards, with other markets taking the Europeans’ lead soon after.

The next step in payments technology was the adoption of the EMV standard, which guaranteed the global interoperability of chip card transactions. Originally standing for Europay, Mastercard and Visa, the three largest payments processing companies, EMV enabled finer controls of ‘offline’ transactions, and improved user security.

When did Electronic Money come in?

In 1837 the British inventors Sir William Fothergill Cooke and Sir Charles Wheatstone obtained a patent on a telegraph system. Sending messages hadn’t been easier since then, as well as sending money. So in 1860 Western Union invented the first international money transfer service, and thereby effectively e-money, when it started offering customers to send money using the telegraph system.

Here’s how it would work. The sender would take the money and go to one telegraph office near his house and ask for their money transfer service. Once the sender had paid money and provided the transfer destination, the operator could transmit a message and “wire” the money to another office, using passwords and codes to authorize the release of the funds to a recipient at that location.

People loved this system because it now you can easily send your money overseas without having to carry bunch of cash on a voyage that would probably cost a greater amount of money that the one you would send. In fact, by 1877 the service was used to transfer almost $2.5 million each year. What could be better right? Well, one bigger thing really stepped in and changed the game, tho. Introducing, The Internet.

When did Digital Money come in?

In early 1980s at the University of California Internet was apparently a thing. Many graduate students involved in its development. David Chaum—one of the student studying there—got his eyes caught by this whole Internet thing. So in 1982, he wrote a paper describing the technological advancements to public and private key technology, in order to create what he called as Blind Signature Technology.

Chaum’s Blind Signature Technology was designed to ensure the complete privacy of users who conduct online transactions. And in 1989, he founded DigiCash, an electronic cash company, in Amsterdam to commercialize the ideas in his research.

However, as Chaum said, “It was hard to get enough merchants to accept it, so that you could get enough consumers to use it, or vice versa.” And while DigiCash filed for bankruptcy in 1998, Its idea of digital cash remains.

How did we move to mobile payment?

Originally mobile payments and other mobile services, like mobile banking, relied on text messaging to complete transactions. And the greater development of computer technology in the late 20th century really allowed online communications to happen.

The very first legitimate online transaction goes to Dan Kohn. On August 11th 1994, Kohn sold a CD of Sting’s “Ten Summoner’s Tales” to a friend in Philadelphia. Kohn’s friend paid $12.48 plus shipping, and he used data encryption software to send his credit card number securely. “Even if the N.S.A. was listening in, they couldn’t get his credit card number,” Kohn told The New York Times.

In 1997, the giant company Coca Cola introduced a limited number of vending machines where the customer could make a mobile purchase. The customer would send a text to the vending machine to setup payment and the machine would then vend their product. Mobile banking first appeared in 1997 as well through the Merita Bank. It accepted text messages for making bank account transactions.

In 1998, entrepreneurs Peter Thiel and Max Levchin launched Confinity, or what we know today as PayPal. Offering low-cost, almost effortless digital payments for consumers and businesses.

The idea was simple and efficient. Convince customers to share their emails, banking and credit card information in return for fast, low-cost payments. Small businesses, online merchants, and consumers quickly signed on, with the company handling more than $3 billion in payments from 10.2 million individual consumers and 2.6 million commercial customers within three years of opening its doors.

Fast forward a decade later, Bitcoin was launched, which marked the start of decentralized blockchain-based digital currencies with no central server, and no tangible assets held in reserve.

What is Bitcoin?

Digital or Electronic money basically gave us all sort of convenience of having any transaction. But there is one problem in the system of how these money is circulated. They all are centralized. Meaning any transaction you do using this “traditional money” are controlled or regulated by a middleman like government, banks, or other authority that issued the money.

You’ll have to trust your card company to keep your details safe. But not all people are willing to give their privacy even to reliable authority. many people have tried to work out how to have a payment system without that middleman. But then there’s another problem, how do you prove that you’ve paid for something or even that you have that money at all without someone vouching for you? in 2008 a solution was offered by an anonymous programmer going by the name of Satoshi Nakamoto.

Nakamoto left a paper on a popular cryptography blog which proposed a system of currency that solved all of these problems. His proposal basically said: “Instead of a bank or credit card company recording every transaction in one central ledger, why don’t all of the users just record all of the transactions at the same time?” thus Cryptocurrency was born.

Cryptocurrency is a completely digitized forms of currency that is exchange through a computer network and is not reliant on any central authority, such as a government or bank, to uphold or maintain it. And while nowadays we have many types of cryptocurrency, Bitcoin is the first of them. But, what is actually what is the difference between transacting using bitcoin and shopping on Amazon with a credit card digitally?

How does Bitcoin work?

Traditional currency transaction goes through a central payment processor like your credit card company. But all bitcoin transactions are processed by a large distributed network of computers, running special software. So, whenever a transaction occurs the network records the senders and receivers bitcoin addresses and the amount transferred and enters this information onto something called a blockchain.

In a blockchain transactions are recorded in a chain of blocks with each block containing a list of transactions and all the information that are verified and secured. is the backbone of cryptocurrencies like Bitcoin enabling secure and transparent transactions. Blockchain also can help prove who owns an asset or who first issued one by creating secure unchangeable records.

The blockchain is updated over a hundred times per day and is sent to every computer that processes bitcoin. Each transaction is encrypted with public key cryptography and all of the users—means every computer that processes bitcoin—would have record and verify the transaction at the same time using identical correct copies of the blockchain. As a result, any attempt to fool the community would be noticed and the payment rejected, it is virtually impossible to counterfeit.

All of these processes are performed by what are called bitcoin miners. A bitcoin miner is a computer or other processing device that is connected to bitcoin processing network. The mining software works by grouping recent transactions into blocks which are only accepted by the rest of the network if the block is hashed correctly, which requires the computer to find correct numerical values to generate a cryptographic solution to solve math problems.

But are people willing to do this time-consuming and compute-intensive process? Well, when a correct solution of a block is reached, the system generates a new bitcoin that is rewarded to the miner(s) who reached the solution first. Your computer basically created money for you out of nothing. So, I just have to sign up for this and never work again, great.

Well, every bitcoin miner are basically a tiny fraction of the bank of Bitcoin. And since miners are required to approve Bitcoin transactions more miners means a more secure network. However, the bitcoin system is designed to generally increases the difficulty of mining as more miner join the network. In the early days you could mine on your spare laptop, then for a while high-end graphics cards were popular choices, but nowadays bitcoin can only really be profitably mined using specialized mining appliances called ASIC miners and they can cost thousands of dollars each. Also they suck a ton of power too, and electricity rates are getting higher and higher, it can kill any chance of profitability of mining bitcoin.

Why do people use Bitcoin?

Like all forms of currency, Bitcoin is given value by its users, supply, and demand. The transaction first that gave Bitcoin monetary value was in October 2009, when Finnish computer science student Martti Malmi, known online as Sirius, sold 5,050 coins for $5.02, giving each Bitcoin a value of $0.0009 each. Fast forward 15 years later, on March 2024, the price of bitcoin set a new record of $73,750, with a market capitalization reaching $1.44 trillion. But, why do people want it?

Well, some people are mistrustful of banks and governments to keep their money secure and have a lot more faith in bitcoin’s blockchain system, especially as more and more retailers begin to accept cryptocurrency. The partial anonymity that bitcoin offers also become one big reason. Every bitcoin addresses are encrypted, plus you could grab a new address for each transaction you make. Also, many VPN services accept bitcoin payment so you can stay incognito online.

Others look at bitcoin as an investment. Because while you can generate new bitcoin by mining, it’ll not be like that forever. Bitcoin is designed to reach its maximum supply of 21 million bitcoins. And once all 21 million bitcoin are mined by the year 2140, no new bitcoin will be created. This means miners will no longer receive block rewards for adding new blocks to the blockchain.This limit ensures that Bitcoin is scarce and cannot be manipulated like traditional currencies, leading some to believe that it’ll be a more secure virtual commodity that will provide a hedge against inflation of traditional currencies. Kind of like how some people invest in gold bars for the same reason.

Whats going to be the future payment system?

Some people genuinely think Bitcoin is the future. But there are problems. Bitcoin is completely unregulated and there is no guarantee of its value. So, investing lots of money in bitcoin is considered speculative level risk of investment, at least for now. Some people might be profiting from getting involved early while others are losing out from this unstable market. The value of one bitcoin recently jumped almost $50,000 in just one year. And while watching the value of bitcoin spike suddenly can be thrilling, I would suggest that you don’t take out a second mortgage on your home just to get in the game because, seriously, bitcoin market is a roller coaster.

So far, we’ve gone through thousands of years of economic and money history. With the rapid change of financial technology, it’s now common to see people making payments with their smartphones just by tapping a merchant terminal. With consumers and businesses quickly adapting to cashless transactions, many believe that the future of the Payments industry is clearly digital while others are terrified that digital world could destroy our economy.

But many from both sides agree that if we can continue to trust the currency we use to work, while keep solving its economic problems, then the way our economy functions could be transformed for the better.

Leave a Reply